Housing prices in Poland in the fourth quarter of 2023

Housing prices in Poland in the fourth quarter of 2023

In the fourth quarter of 2023, the growth in apartment prices accelerated. In the 17 largest cities, prices rose about 14% year over year in both markets. This means higher dynamics compared to the third quarter of 2023, when prices increased by 9-10% (y/y). Housing price growth also outpaced nominal wage growth, which averaged just over 10% for the quarter.

In the fourth quarter of 2023, the growth in apartment prices accelerated. In the 17 largest cities, prices rose about 14% year over year in both markets. This means higher dynamics compared to the third quarter of 2023, when prices increased by 9-10% (y/y). Housing price growth also outpaced nominal wage growth, which averaged just over 10% for the quarter.

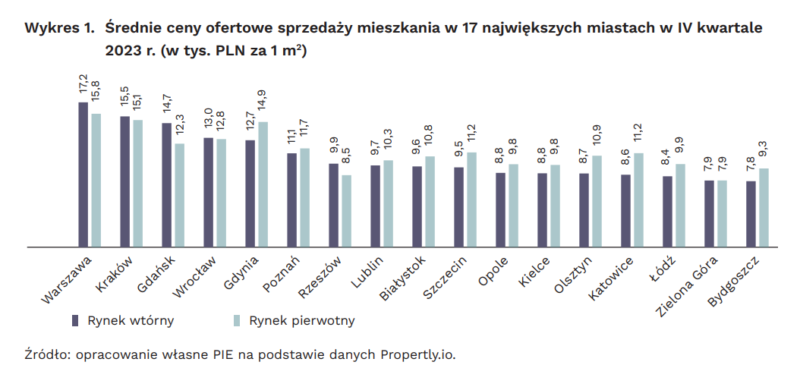

The highest prices were in Warsaw and Krakow. In the capital, per square meter we had to pay more than 17 thousand zlotys on the secondary market and 15.8 thousand zlotys on the primary market, and in Krakow - 15.1 thousand zlotys on the primary market and 15.5 thousand zlotys on the secondary market for square meter. In Krakow, in both markets, the average price per square meter increased by more than 25% compared to the fourth quarter of 2022. Price increases exceeding 15% (year/year) were also observed in other large cities. In Warsaw, growth was 21% in the secondary market and 17% in the primary market.

There are more and more offers for the sale of apartments

At the end of the year, the number of new offers of apartments for sale increased after a decrease in the third quarter of 2023. The seven largest cities saw 5.7% more new listings per week (y/y). In cities where offers for the sale of new apartments did not increase in the fourth quarter of 2023, there was a significant increase in prices. In Warsaw, the number of new listings decreased by 15%, and prices on the secondary market increased by 21% compared to last year. In turn, in Krakow the supply of new properties increased by 2%, and prices on the secondary market increased by 26%.

Warsaw remains the largest market for apartment sales. In the fourth quarter, the market received an average of more than 1,700 new offers per week. However, this is a worse result than in previous quarters of 2023, during which more than 2,300 new sales listings appeared weekly.

Stable rental prices and increased supply of apartments for rent

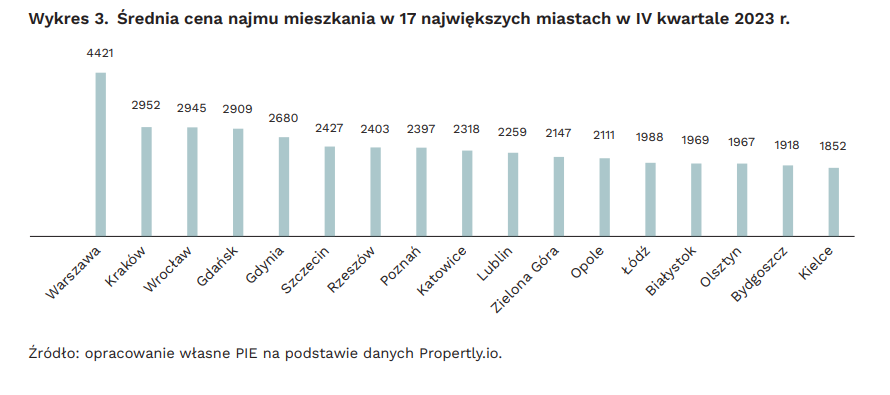

On average, in the largest cities, apartment rental prices increased by 2% (year/year). In the most expensive city – Warsaw – they increased by 9% (year/year). In the capital, renting an apartment in the fourth quarter of 2023 cost, on average, more than 4,400 zlotys. The next places are occupied by Krakow, Wroclaw and Gdansk, where prices range from 2900 to 3000 zlotys.

The number of new rental listings in the seven largest cities in the fourth quarter of 2023 increased by 21% (yoy). In Warsaw the number of offers increased by 36% (year/year), and in Wroclaw by 34%. In quarterly terms, the rental market in 17 cities decreased by an average of 10%. However, the quarterly decline is seasonal in nature and is due to a significant increase in the supply of apartments for rent in the third quarter due to the end of the school year. Traditionally, the largest supply of apartments for rent appears in Warsaw, where, on average, more than 2,000 new apartments are added per week. In other cities the number of new proposals does not exceed 1000.

The increase in the supply of apartments for rent is due to the release to the market of apartments purchased in 2021 for investment purposes. At that time, there was high interest in purchasing apartments for rent from both institutional and private investors looking for a safe investment of their capital. At that time, renting an apartment was favorable compared to interest rates on bank deposits and 10-year Treasury bonds. The year-end increase in supply was the result of new apartments coming to market following a record year in 2021, in which construction began on nearly 300,000 apartments.

Rental profitability in Poland's largest cities decreased at the end of 2023. The average profitability level was less than 5.6%. A decrease in the fourth quarter was recorded in all six cities analyzed – even in Gdańsk, where the figure increased for three quarters. The profitability index has decreased the most since the beginning of the year in Lodz – by 1.5%. The continuing downward trend is caused by a significant increase in prices for the sale of apartments with relatively stable rental prices.

The segments of the smallest and largest apartments are characterized by the highest profitability. And in the case of an area of less than 25 m2 and more than 90 m2, the profitability is more than 6%. Micro-cavalier apartments are characterized by the highest level of profitability of 6.6%. The least profitable is renting apartments of average size. In the group of apartments with an area of 41-60 m2, this figure was 5.3%.

Source: pie.net.pl

Blog

How many Poles live in rented apartments?

How many Poles live in rented apartments?

Prices for rental housing in Poland in November 2023

Prices for rental housing in Poland in November 2023